On Monday, 4/27, the PPP loan program relaunched with $310B available. Learn if you should apply, where to apply & what’s changing in this second round of PPP.

Updated 5/20/2020: The PPP Loan Forgiveness Application is now available; we also added a Maximum PPP Loan Forgiveness Amount Calculator to help you calculate PPP loan forgiveness amount.

As part of the CARES Act, the Paycheck Protection Program (PPP) was designed to provide emergency funds for small business owners. As you may know, the first round of funding, approved by Congress on March 27, ran out less than two weeks after applications were opened.

Congress approved a new package with additional funding for small businesses. It’s highly likely that the funds will run out quickly again. If you were planning on applying for a loan, we recommend that you start your application as soon as possible.

We’ve included some FAQs to help provide more information.

How much funding is in this second round of PPP?

Congress approved $310B in new loan money for the PPP, with $60B of that reserved for smaller lenders with the aim of serving very small businesses.

When are applications open?

Applications are open now.

Are any of the rules changing from the first round?

One of the biggest changes is that small businesses with employees were prioritized in the first round. While the first PPP applications opened on April 3, it was not until April 15 that the SBA published guidance in the Federal Register clarifying how to calculate eligibility for self-employed individuals without employees. Funding for the program ran out the next day.

In the second round, we believe lending partners are better versed and ready in processing loan applications for self-employed individuals without employees.

Note: Nearly 5,000 lenders participated in the program the first time around. The application process, requirements and speed will vary depending on which lender is used.

What counts as an employee? Must they be full time?

According to the SBA, part-time and temporary employees are counted the same as full-time employees. (See more detail here.)

Where should I apply?

Nearly 5,000 lenders have already participated in this program.

If you have an existing relationship with a lender who is participating, and you meet the eligibility criteria established by that lender, that may be the most desirable option.

If you do not have a relationship with a qualified lender, the SBA lists PPP lenders by location here.

A community member shared that FanBank has been helping microbusinesses/self employed with loans.

What is the Paycheck Protection Program (PPP) again?

As a reminder, PPP loans are for small businesses that have experienced damages due to the coronavirus and either generated a profit as a single-person business or paid employees salaries and payroll taxes. The loan amount will be forgiven (that is, it will not have to be paid back) as long as the loan is used to cover payroll costs (including your own wages if you’re a single-person business), mortgage interest, rent and/or utilities over the 8-week period after the loan is made. Learn more about PPP and other coronavirus stimulus aid here.

Should I apply for PPP?

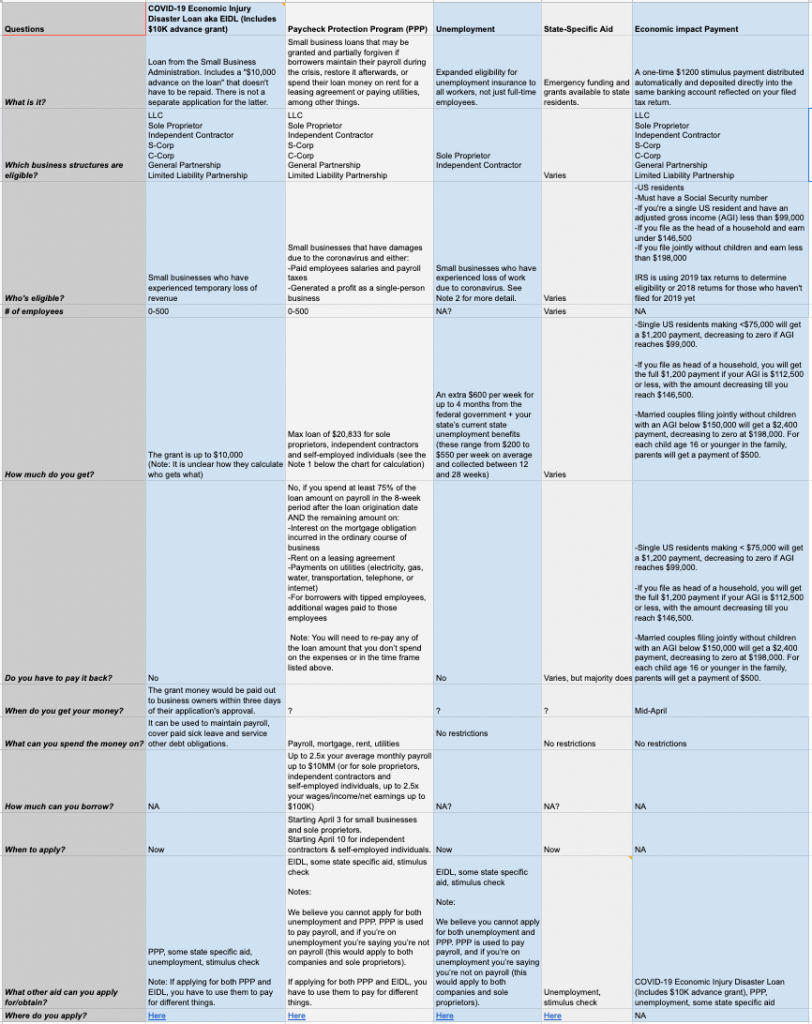

If you don’t know whether you should apply for PPP, please check out our comparison chart summarizing PPP vs EIDL vs Unemployment for Self Employed Individuals and the differences between them. To view the chart, click here or on the image below.

Note that we believe you cannot apply for both unemployment and PPP. PPP is used to pay payroll, and if you’re on unemployment you’re saying you’re not on payroll (this would apply to both companies and sole proprietors). Because of this, you may want to calculate how much you would receive from Unemployment and compare that to how much you would receive (and that would be forgiven) in a PPP loan, and apply to the program that provides the greater benefit.

Can I apply for second round PPP if I was previously denied?

Many have asked if they can apply for PPP this second round if they had been previously denied. The answer depends. If you had successfully applied for PPP and were denied a loan, we don’t recommend applying again as it likely won’t change the government’s decision. However, if you were unable to apply for PPP because the bank you went to reached its lending cap or you were denied a chance to apply because you didn’t have an existing relationship with a bank, we recommend trying again this second round PPP if you believe this is the best decision for your business.

Can I submit multiple PPP applications?

Please note that if you have a PPP application pending, you should not submit a new one. You will need to wait until that application is fully resolved before submitting another one because you can only receive one loan under PPP.

Have you found a bank that’s loaning to self-employed people?

Please share with the community by leaving a comment below!

Disclaimer: The information about these programs is changing rapidly. Like you, we’re doing our best to interpret the structure of each of these new programs, but without hard guidance, a lot of available information is based on interpretations of how these programs will work. Please keep this in mind and speak to a representative at your local lender or the SBA for more details.

How do I apply for PPP loan forgiveness?

To apply for PPP loan forgiveness, you must complete the PPP Loan Forgiveness Application as directed and submit it to the lender servicing your loan. You may also complete the PPP Loan Forgiveness Application online through your lender.

More Resources

- Business Continuity Plan for Small Business – How to Prepare Your Business for Coronavirus – 18 protection steps

- What to Say When: Swipe Copy for Responding to Coronavirus Scenarios

- How to Manage Your Mental Health in the Face of Coronavirus Uncertainty

- Coronavirus & Small Businesses Resource Hub

- Force Majeure Clause Sample [Free Template]

- Small Business Relief Resources for Coronavirus

- How to Initiate Postponements and Cancellations Regarding Coronavirus (& What to Do With Your Client Contracts)

- How to Prevent Event Cancellations [Plus, Free Email Templates]

- Coronavirus and Marketing: How to Update Your Marketing Strategy & Messaging

- How to Avoid Disputes: Proactive & Quick Communication Is the Key

- Self Employed Unemployment and Coronavirus Stimulus Package: Everything You Need to Know

- [Video] An Update From The Legal Paige on Force Majeure & What It Means for Your Business

- How to Make Money During Quarantine: 19 Ideas to Add Revenue Now