If you’re starting your independent business or looking to get more organized, invoicing is a great place to start. Ensure you’re getting paid as quickly as possible and document all your transactions. Learn more, and leverage our free templates.

As an independent business owner, you need a reliable way to get paid for your services. You’ll need to send your clients professional, detailed invoices so they know exactly how much to pay you, when, and where to send their payment.

This article is a comprehensive guide that will teach you the importance of invoices, how to create and send them, and how to use online invoicing software to streamline the process. You’ll find out how to get paid quicker and offer your clients the optimal experience to improve your cash flow.

📍Explore more on invoicing:

Invoicing tools

- The best invoicing software for self-employed use

- Compare the best invoice software for small business

- The 7 best invoice apps for small business

- 8 invoice examples and templates for every industry

Invoicing best practices

- What is an invoice?

- How to invoice as a freelancer

- Guide to professional services billing

- Invoice vs. receipt: when to use each for your business

- How to create an invoice and get paid fast

- How to send an invoice

- 8 invoice payment strategies for quickly getting paid

- How to use HoneyBook invoices to increase your revenue

Jump to:

- What is an invoice?

- Elements of an invoice

- Why invoices are important for small businesses

- How to create an invoice

- How to invoice in minutes with templates

- Best practices for billing your clients

- Why you should avoid manual invoicing

- Using software for creating and sending invoices

- Manage your entire clientflow with one platform

What is an invoice?

An invoice is a document that lists the payment due for services rendered. At a minimum, it should list a description of the services performed, the total amount due plus taxes, and instructions for payment. The instructions should include a “remittance” address (an address where clients can send a check) or a website where they can pay online.

Invoices are not just documents sent to clients to receive payment. They play a more important role in the transaction. They represent your organizational capabilities and your professionalism. For that reason, they should be accurate, professional, and cohesive with your brand. Invoices are just as much an opportunity to impress your clients as any piece of marketing. Show your clients that you are a serious (or seriously good) small business owner with presentable and professional files.

What are the elements of an invoice

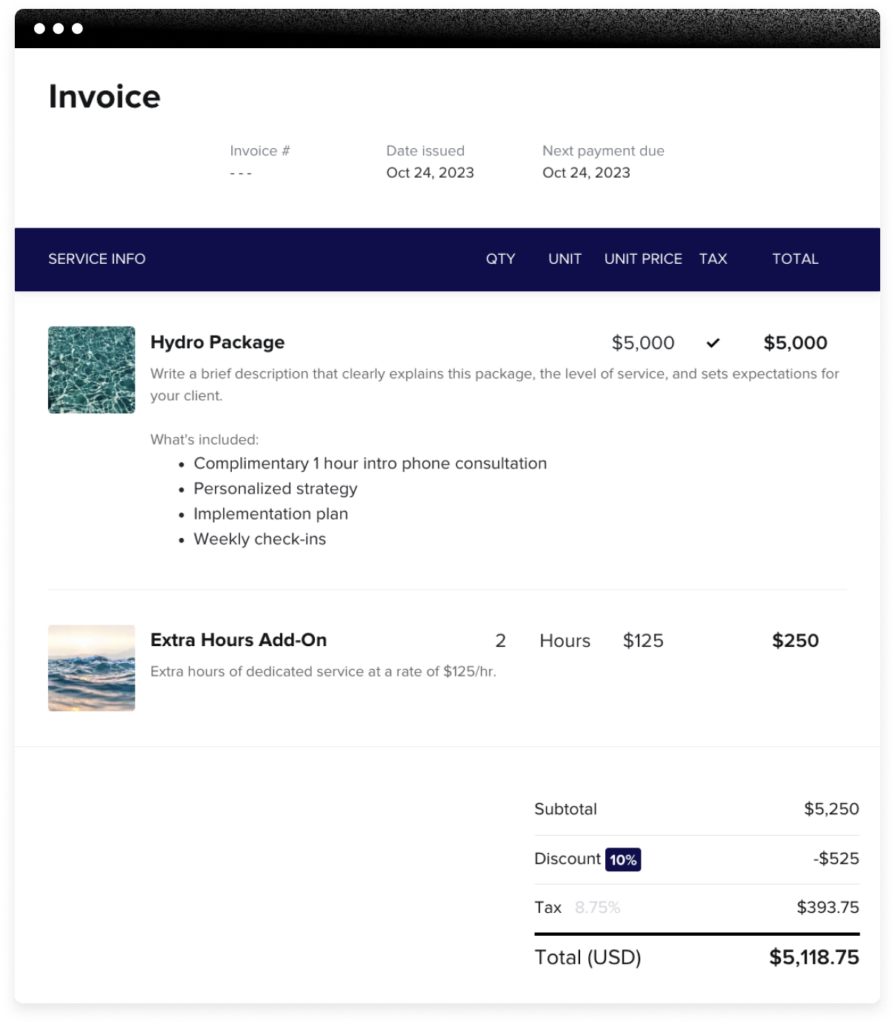

There are a few elements all invoices should include. This information must be accurate and clear to move your clients to pay faster. If any of the details are confusing, it may delay their payments. Wondering exactly how to create an invoice? The first step is to make sure to include the following items:

- Title (usually “Invoice” at the top of the document)

- Invoice number (each one should have a unique number)

- Date issued and billing period dates

- Your business name and address

- Your contact information, including your email address and phone number

- Address or P.O. box to send a payment, if different from the business address

- The “Bill to” field with the client’s name

- The dollar value of the services and any materials, if applicable

- Subtotal before taxes

- Discounts such as promotional codes

- Total amount due, including any taxes

- Payment schedule, including payment due dates

- Payment methods, such as debit and credit cards, ACH bank transfers, or checks

- Terms of payment, including information about late payment fees

Why invoices are important for small businesses

A streamlined booking process can improve your cash flow by increasing your chances of getting paid on time, with as little hassle as possible. This can lead to better reviews, repeat business, and steady revenue from ongoing services with recurring payments.

Invoices are also important records for your accounting. They allow you to track accounts receivable, cash flow, and total revenue. You can also track unpaid invoices and send payment reminders for overdue balances. Invoices serve as records for transactions, which may be useful, along with an online contract, if disputes arise. For that reason, they must be accurate and clear, and both you and your client should have identical copies.

On the client’s end, invoices help them keep financial records of the services they’ve paid for. Professional and accurate invoicing can instill confidence and trust in your services and ultimately foster loyalty and repeat business.

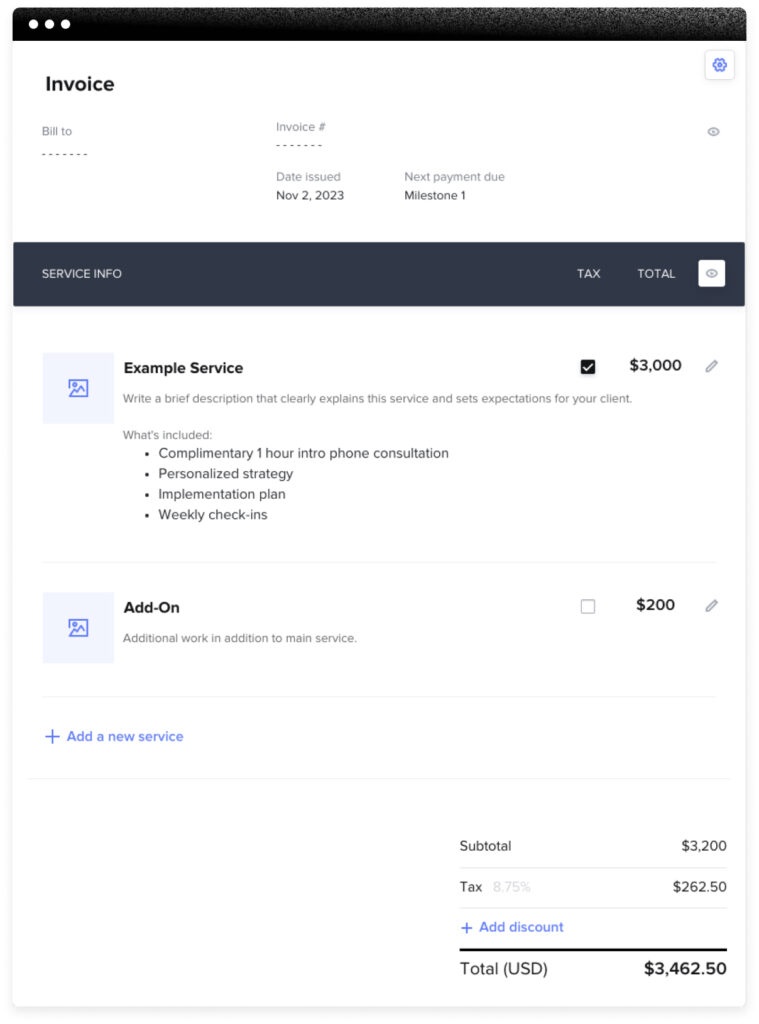

How to create an invoice

Creating an invoice is easy for all types of businesses with the right tools and software. One of the easiest ways to get started is to use an invoice generator or templates. With HoneyBook’s online invoice templates, you can filter by industry and select the options that best suit your business. From there, it’s easier to customize your templates by including your logo, business information, and client/project information.

By making your invoice process repetitive, it becomes faster to send them and get paid. Follow these steps to create each invoice:

- Start by compiling the costs of each service rendered.

- Gather your client’s information.

- Decide if you want to write an invoice from scratch or choose from an array of templates.

- If using an online template, see if there are any ready-made templates for your industry.

- After you’ve chosen a template, you can include your logo and banner image.

- Fill in all the required fields, including your company name and email address, your client’s name, each service provided, and the cost of each line item.

- Invoice software will automatically show the total amount due after taxes, or you can calculate them on your own.

- You can send the invoice via email in one of two ways: print the PDF and email it to the client with instructions on how to pay through your clientflow management platform, or email the client with a link to the invoice where they can pay online.

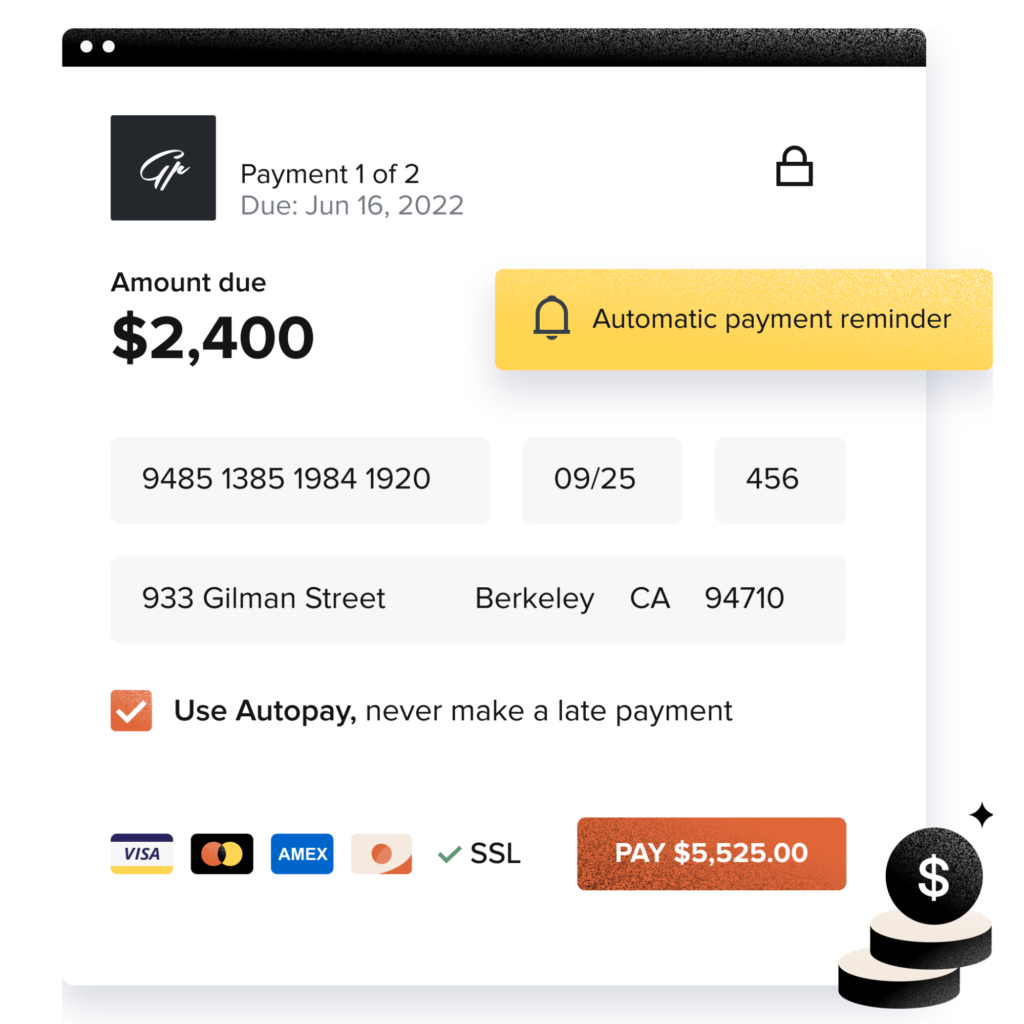

- Set up automatic payment reminders and late payment notices.

- Follow up with clients and thank them for their payment or remind them of the amount due if the payment is late.

How to invoice in minutes with templates

Invoice creation should include the basic information and payment details listed above, but variations between industries and specific jobs occur. So, how do you know which type of invoice to create? That’s where invoice templates come in.

Invoicing software with built-in templates can significantly help your business. With paper invoices being a thing of the past, providing digital invoices is essential for small businesses that want to be seen as professional and get outstanding invoices paid. Here’s how online software for invoicing can help you.

1. Ease of use

Some of the most significant advantages of using invoicing software with templates are ease of use and time efficiency. With pre-designed templates, you no longer have to create invoices from scratch for each client or transaction. This not only saves you valuable time but also reduces the likelihood of errors that can occur with manual data entry. The simplicity of selecting a template, customizing it with specific client details, and sending it off makes the entire process more efficient, allowing you to focus more on your business and less on administrative tasks.

2. Consistency and professionalism

Invoicing templates offer a consistent layout and structure, which helps establish and maintain professionalism in your communications. Having a well-designed invoice template with your business logo, color scheme, and font elevates your brand’s identity and leaves a memorable impression on your clients. Consistent branding across all your business documents, including invoices, also enhances your professional image.

3. Customization for different client needs

Modern invoicing software offers a range of templates to suit different business needs and service types. Whether you’re billing for a one-time service, recurring services, or special project work, there’s a template that fits the bill. This versatility is vital for tailoring your invoices to the specific nature of each job. For example, a project-based invoice might include detailed breakdowns of milestones and corresponding costs, while a recurring service invoice might focus on dates and fixed rates.

4. Speeding up the payment process

The clarity and completeness of information in these templates can significantly expedite your billing process. By providing all necessary details—such as payment terms, methods, and due dates—in a clear and accessible format, you reduce client queries and confusion. This clarity not only enhances client satisfaction but also encourages timely payments so you can settle outstanding invoices with ease and get back to growing your business.

Explore HoneyBook’s variety of invoice templates below, sorted by industry:

- Cleaners

- Coaches

- Consultants

- Designers

- Doulas

- Graphic Designers

- Interior Designers

- Photographers

- Tutors

- Virtual Assistants

Best practices for billing your clients

Billing your clients is one of the most important parts of booking. You don’t necessarily need to put a lot of time and effort into it. However, your clients will notice if any part of the process is confusing or insecure. Use the best practices to make sure you’re billing clients correctly and with confidence, so you can create a better client experience and collect invoice payments faster.

- Stay clear and concise — Include enough information to outline your services, balance due, and payment terms. Be sure to avoid extraneous or confusing information that can prevent you from getting paid on time.

- Automate the process — Take work off your plate by automating as much as possible. Set up payment reminders and even automate when your invoice sends to clients if you let them book with you instantly.

- Offer a variety of payment methods — Your clients will appreciate an easy way to pay, so it’s best to offer options. These days, almost everyone prefers online methods, making it beneficial to accept credit card processing and ACH transfers. When you collect online payments, you’ll get paid faster and make it easier for yourself to track your cash flow.

- Invest in software — PDF and Word doc invoices are things of the past. With those methods, you’re putting more work back on your clients. Instead, invest in invoice apps or software that lets you send electronic invoices. With the right software, it can even integrate with payment processing, making the process easier for both you and your clients.

- Accept online payments — No one wants to dig for their checkbook, and we bet you don’t want to wait by the mail just to get paid. Stick with online payment options, which you can provide along with your invoice or integrated with the invoice itself.

- Templatize so you can personalize — Templates let you move faster when it comes to most of your business processes. By using templates, it’s easier to personalize. You don’t have to focus on the entire invoice, but you can easily send a more unique message tailored to each client when you don’t have to worry about spending more time on the invoice itself.

Why you should avoid manual invoicing

The shift from traditional paper invoices to digital invoices and invoicing software isn’t just a trend — it’s the inevitable future.

Human error in manual invoicing can lead to discrepancies, which are time-consuming to deal with and can damage your client relationships. Digital invoices minimize errors by enabling automatic calculations, ensuring that totals, taxes, and discounts are accurately applied. Most invoicing software also keeps a record of all transactions, making it easier to track and address any discrepancies. Especially for those running small businesses, and often working solo manual invoicing might seem easier to start, but eventually, creating a basic process is crucial. For example, creating just one coaching invoice template can save valuable time whenever onboarding new clients.

Additionally, using online software for digital invoicing simplifies tracking and managing your finances. Invoicing software usually includes features that allow you to monitor which invoices are paid or overdue and the overall financial health of your business. This real-time visibility is crucial for effective financial management and planning. Digital invoicing also facilitates quicker payment. Creating and sending digital invoices via email through online software reduces the time it takes for an invoice to reach the client compared to traditional mail.

Clients increasingly expect the convenience and efficiency of digital interactions. Offering digital invoices aligns with these expectations, enhancing client satisfaction while also providing you with benefits that paper invoices don’t offer.

How to choose the best software for creating and sending invoices

Not all invoicing software is the same. To help you choose the best software for creating digital invoices, look for the following:

- Rapid invoice creation: Essential for efficiency, invoice software should allow for quick invoice generation. Features like user-friendly interfaces, customizable templates, and the ability to modify past invoices save valuable time.

- Payment status tracking: Choose invoicing software that offers real-time tracking of invoice statuses. A dashboard showing which invoices are paid, pending, or overdue aids in effective cash flow management and quick resolution of payment issues.

- Automatic payment reminders: Software that automates payment reminders helps prevent overdue invoices by alerting clients about due and overdue payments, reducing the need for manual follow-ups.

- Customization and branding: Opt for software that allows for customization. Adding your business logo and brand elements to invoices enhances professionalism and brand recognition.

- Automatic billing for recurring payments: If your business model includes recurring services, choose software that supports automatic billing cycles. This feature is important for consistent and timely billing of recurring services.

Overall, the ideal invoicing software for small businesses should offer multiple features to get your invoices settled quickly and prevent late payments.

Manage your entire clientflow with one platform

Invoicing is just one step of your clientflow process. As a small business owner, you also have to consider your process for organizing and sharing client contracts, scheduling, and ongoing client communication. Enhance your efficiency by adopting a unified platform that addresses all of these client touchpoints.

HoneyBook is an all-in-one clientflow platform that simplifies invoicing, communication, scheduling, and a whole host of other vital touchpoints in client management.